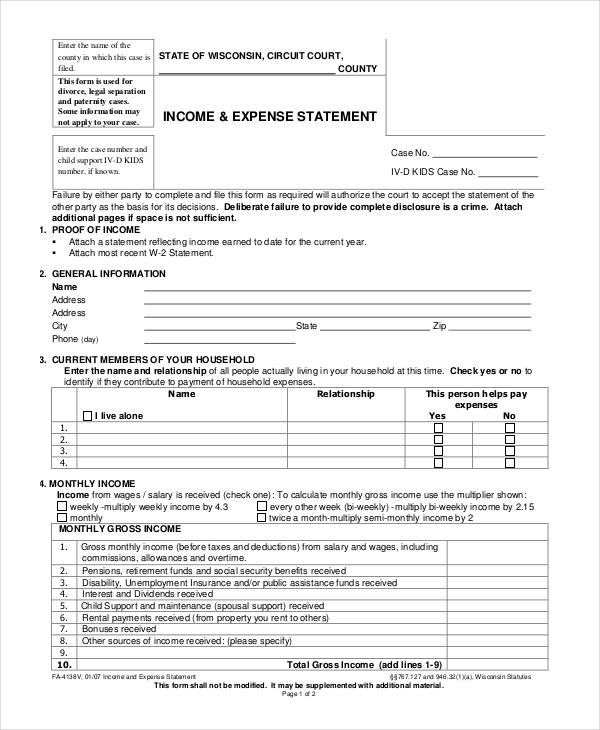

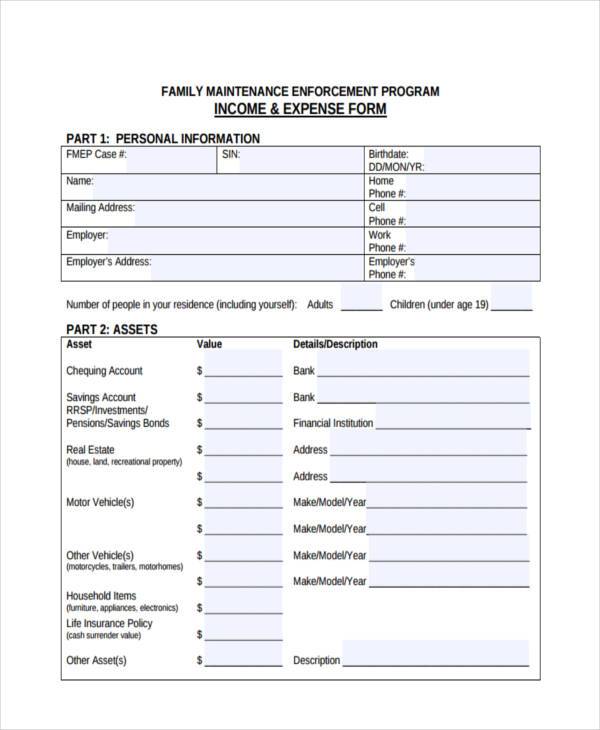

They are automatically sealed in a non-public court file (this is why they are referred to as “sealed financial source documents”). These documents are not part of the public court record of your case. If you own a 5% of more interest in any company that files a tax return, you will also need to include the company’s complete tax return for the last two years. The main documents that the court requires are your previous six months of pay stubs, the previous six months of statements for any bank, savings or investment account that you operate (but not credit card statements), and the last two years’ tax returns including W-2’s (and/or 1099’s for those who are self employed). And in order to verify that the information you have given in your declaration is correct, you need to file certain financial documents along with your declaration. Sealed Financial DocumentsĪ financial declaration needs to be based (as far as possible) on your financial records, and not just on your best guess about the money you earn and spend. The purpose of the draft - and it is just a draft - is to give your attorney the most information you can so that we can file a financial declaration that is both accurate and presents your case in the best possible light. Your attorney will review that draft with you and work with you to make any necessary changes before it is signed by you and then filed with the court. These instructions are designed to help you prepare a first draft of your financial declaration. Don’t underestimate your attorney’s ability to use creative solutions you might not think of to present a financial declaration which is both honest and strongly presents your position. It’s critical to be up front with your attorney about all sources of income and spending. Keep in mind that this is a sworn declaration under penalty of perjury Accurate financial declarations often show a lot about the spending habits, lifestyles and even the credibility of each party. The court will look closely at both parties’ financial declarations to assess need and ability to pay spousal support and other financial obligations.

This is sometimes the most important document you and your attorney will file in your entire case. Both parties need to file a sworn financial declaration (under penalty of perjury) whenever child support, maintenance, attorneys’ fees, or any other financial issue needs to be determined.

A financial declaration gives the court an overview of your monthly income and monthly expenses.

0 kommentar(er)

0 kommentar(er)